Failed Australian-based music streaming service Guvera is under investigation by a corporate watchdog after 3,000 investors questioned where their $180 million in investments have ended up.

The ABC reports that some of Guvera’s investors have been questioned by the Australian Securities and Investments Commission (ASIC) after allegedly being promised huge returns on their investments, which haven’t come to fruition.

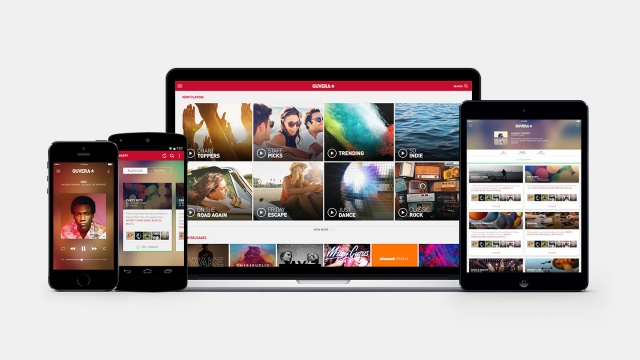

…